A practical solution for automated monitoring of tax-related processes in ERP systems

Specific and complex transactions complicate the correct VAT treatment.

Cross-border business entails extra tax obligations and risks.

Ever-changing supply chains, outdated tax determination processes, limited personnel resources and lacking information make it difficult for tax and finance functions to ensure correct VAT treatment and reporting.

VAT transactions are often great in number. Even a small error can have a major effect, not only in terms of tax payments, interest and fines but also in terms of personal consequences for the legal representatives of the company. Unfortunately, even honest, law abiding companies and their CEOs, CFOs and other persons in charge with taxes may suddenly find themselves subject to investigations.

KMLZ offers a convenient solution for the automated analysis and monitoring of tax-related processes in ERP systems with its TAX Suite.

It uses data and process mining technology from Celonis to perform highly efficient controls without IT resources or technical ERP expertise.

VAT Manager

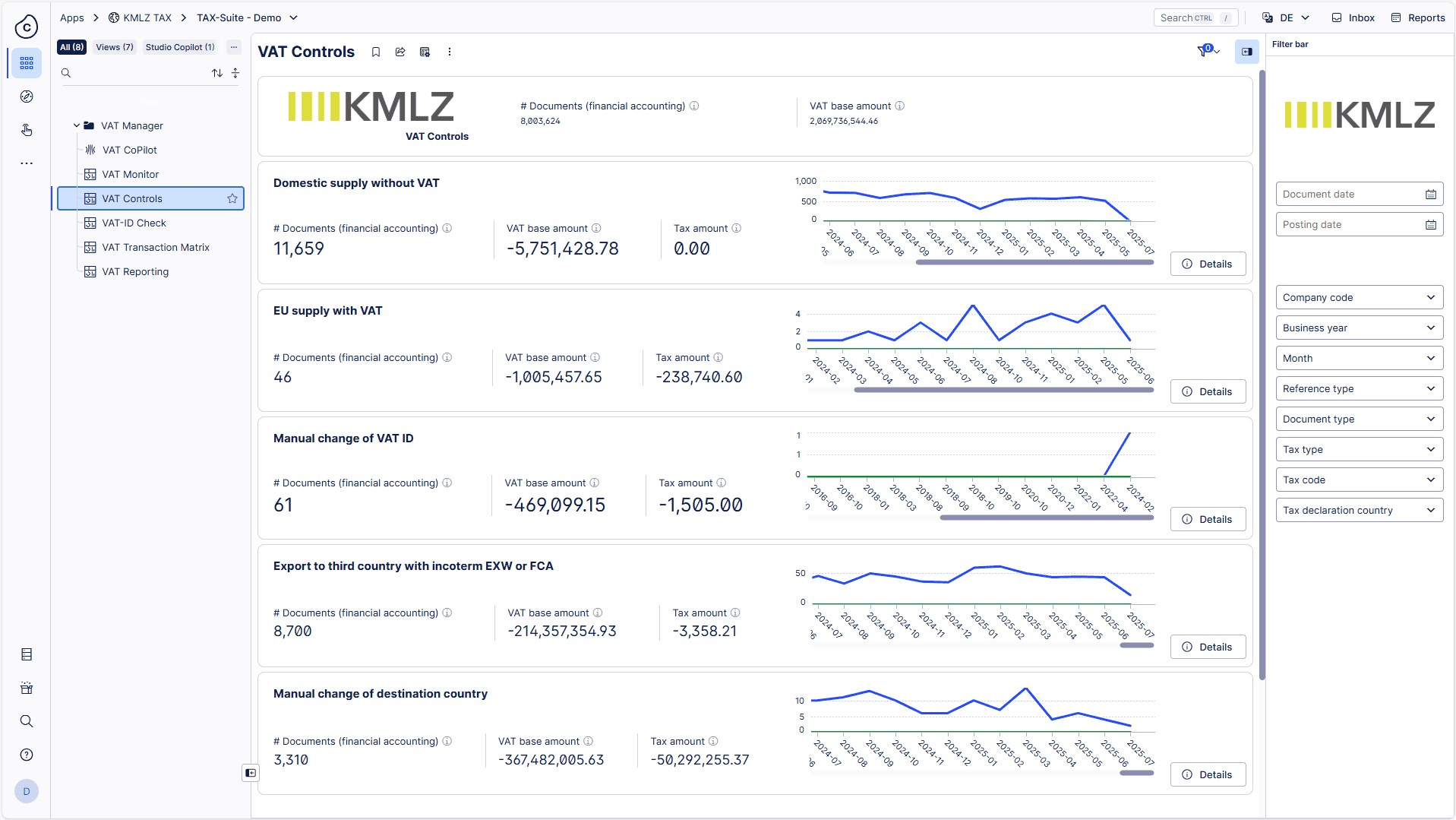

The VAT Manager within the TAX Suite provides a continuous tax control system for assessing and monitoring VAT transactions in ERP systems. It helps users identify potential risks and errors before they occur. The VAT Manager of the TAX Suite consists of the following modules:

Using the VAT Controls module, predefined checks can be carried out fully automatically. This enables the identification of anomalies and risks. The checks can be performed in real time, and potential errors can even be detected before they materialize. By documenting the checks and their results, the module can be used as an IT-supported component of a Tax Compliance Management System (TCMS).

In the VAT Monitor module, all tax-relevant data related to transactions is available within seconds and presented in a highly user-friendly format. The processing workflows within the source systems are also visualized. This module provides the tax department with convenient access to transaction-specific tax information, which is particularly useful for tasks such as reconciling VAT returns.

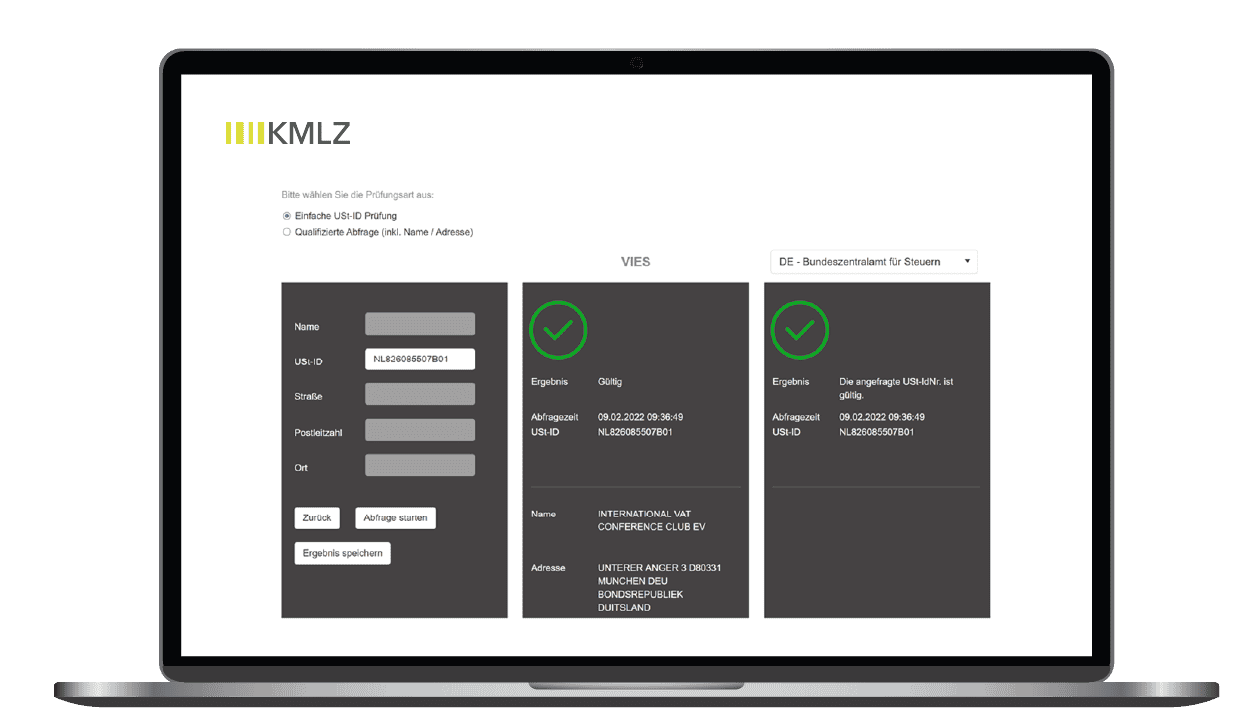

With the VAT-ID Check module, it is possible to check all VAT IDs stored in the system in real time, either regularly or on an ad hoc basis, via VIES or FinanzOnline. The query results are saved and are available for each individual transaction.

The VAT Transaction Matrix module is designed to enable users to quickly identify and analyse the most significant categories of business transactions for VAT purposes. A comprehensive business transaction matrix can thus be generated at the touch of a button.

Avoiding time-consuming manual work for tax and finance functions through automated controls

Documentation of the performed controls as part of a TCMS.

Presentation of all tax-relevant information from the source systems in one place.

AI integration into existing MS Office 365 applications

Integration with external systems and national and international databases.