The procedural documentation serves to comply with requirements for IT-supported processes established by the tax authorities as ‘Principles for the proper storage of books, records and documents in electronic form and for data access (GoBD)’ (Federal Ministry of Finance's letter dated 28 November 2019, BStBl. I 1269). In the version of the GoBD applicable from 1 April 2024, the Federal Ministry of Finance is adapting the GoBD to legal changes and technical developments (see KMLZ VAT Newsletter 19/2024: GoBD 2024: What’s new? – Procedural documentation and TCMS rewarding for tax audits). Taxable persons are once again required to maintain procedural documentation and adapt their procedural documentation to the new technical requirements.

What is a procedural documentation?

Procedural documentation is the sum of the documentation of IT-supported data processing systems and the process descriptions contained therein. All data handling processes relevant to VAT and accounting, and the underlying systems are presented.

In connection with procedural documentation, there are a number of terms that need to be defined:

TCMS: Tax Compliance Management System (see KMLZ VAT Newsletter 03/2023: Tax compliance management: Germany is taking it seriously)

CMS: Compliance Management System

ICS: Internal Control System

DMS: Document Management System

GoBD: Principles for the proper storage of books, records and documents in electronic form and for data access

What is a TCMS or CMS?

A tax compliance management system is the VAT-related component of a compliance management system that serves to ensure complete and timely fulfilment of VAT obligations and compliance with the law.

What is an ICS?

The Internal Control System for VAT (ICS) is a system for ensuring that the target state is implemented and maintained. It regularly includes an IT control system. It is part of the (T)CMS and the procedural documentation.

What is a DMS?

A document management system refers to the database-supported management of electronic documents. This includes the digital capture of documents and the conversion, storage, preparation, archiving, etc. of these documents. In the accounting system, the DMS represents a sub-area within the process documentation.

What are the GoBD?

The GoBD are the principles for the proper management and storage of books, records and documents in electronic form and for data access. They originate from an administrative instruction issued by the Federal Ministry of Finance. In this instruction, the Federal Ministry of Finance formulates the minimum requirements for processes, systems, data security, the internal control system and procedural documentation.

In what way does all this relate to procedural documentation?

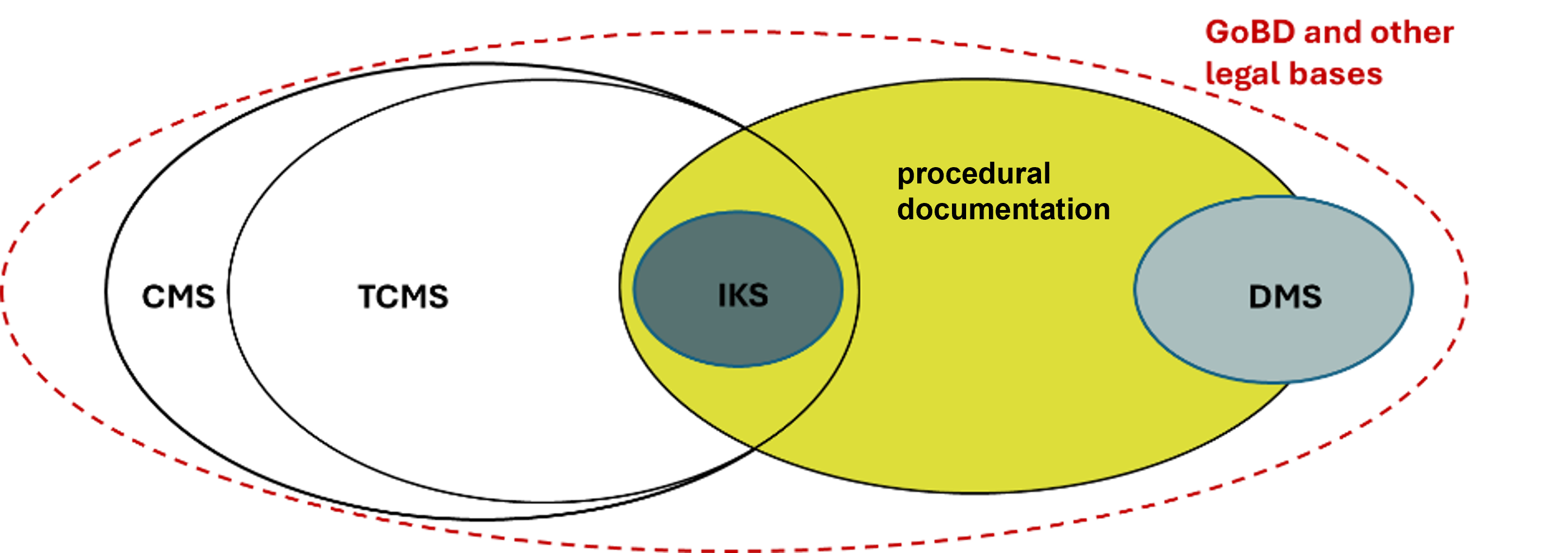

The term ‘procedural documentation’ is the umbrella term for the ICS and the DMS but goes beyond them. Procedural documentation serves to implement the GoBD and is part of the TCMS. The context can be illustrated as follows:

What is the legal background to procedural documentation?

Section 145, para. 1 of the German Fiscal Code (AO) requires that the accounting records must be arranged so that they can provide an expert third party with an overview of the business transactions and the situation of the company within a reasonable period of time. The procedural documentation must therefore provide a compact overview of all accounting and VAT-relevant processes. Sections 146 and 147 of the German Fiscal Code even stipulate that procedural documentation is mandatory if the traceability and verifiability of the accounting records cannot be guaranteed in any other way. This documentation must demonstrate that the accounting records and entries are stored in an orderly manner and cannot be altered.

The GoBD contain requirements that are relevant for all data processing systems that directly or indirectly collect or process VAT-relevant data. This includes minimum requirements for processes, systems, data security, the ICS and also the procedural documentation. The latter is intended to make formal and factual security verifiable by documenting all system and procedural changes in terms of content and time without any gaps. An automated IT control system within the TCMS and the consolidation of control functions in the procedural documentation help the company to comply with the requirements for ongoing control of VAT risks.

Why should I establish procedural documentation for my company?

The procedural documentation is a means of fulfilling the requirements imposed by the GoBD and the statutory requirements regarding accounting and record-keeping (Sections 145–147 of the German Fiscal Code). It also offers advantages for the company itself:

Internal processes are made transparent. Processes are secure thanks to clear and concise explanations of procedures.

The induction of new employees is made easier, and processes can be easily maintained during holiday periods/staff changes.

Responsibilities and accountabilities are documented.

Relevant documents and records can be easily retrieved.

Processes can be reviewed and optimised.

Procedural documentation is particularly useful in the event of a tax audit:

It enables the tax auditor to quickly identify the relevant processes, thereby speeding up the tax audit.

Relevant documents are quickly to hand and can be easily made available.

The tax auditor starts the tax audit with a good first impression.

Risks due to incorrect records are minimised.

The accounting becomes traceable and verifiable.

How can the procedural documentation be created?

Various areas must be outlined in the procedural documentation. This affects not only document processing but also numerous upstream and downstream processes, i.e. all areas with data processing systems.

The most important components of procedural documentation are:

General description: contains general information about the company and the organisation

User documentation: documents the proper operation of the data processing system

Technical system documentation: technical description of the IT application/data processing system

Operational documentation: documentation of the proper application of the procedures

Internal control system: summary of the control functions of the procedural documentation

What technical requirements must be observed concerning GoBD/procedural documentation?

With the so-called Z3 access, data subject to recording and retention requirements can be transferred to the tax authorities in any machine-readable format. In addition to data carriers, this also includes, for example, transfer via data exchange platforms to which the tax authority has granted access (Section 87a para.1 of the German Fiscal Code). In accordance with Section 197 para. 3 of the German Fiscal Code, the tax authorities can now request the submission of documents prior to the start of the audit.

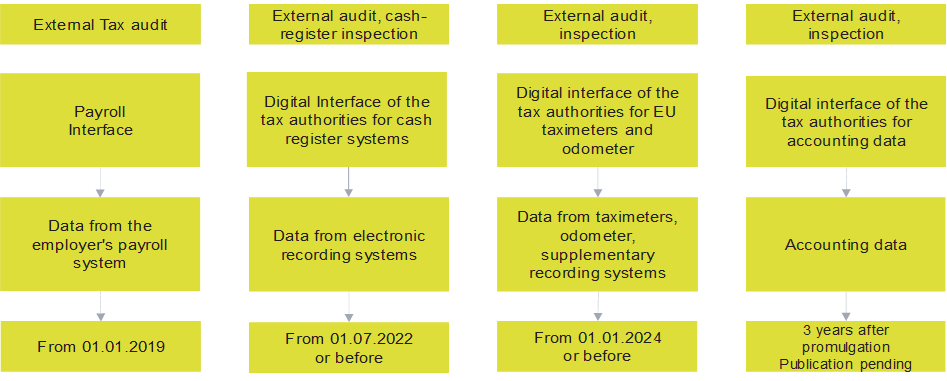

Accurate accounting is important as a basis for taxation (Section 158 of the German Fiscal Code). This is because if the electronic data has not been made available in accordance with the specifications of one of the prescribed digital interfaces of the tax authorities (Section 158 para. 2 No. 2 of the German Fiscal Code), it cannot be used as a basis for taxation and the taxable person risks having their accounts rejected during a tax audit. To be on the safe side, companies should ensure that data is provided via the following interfaces:

The annex to the GoBD contains a positive list of supported file formats for the audit software and a negative list of file formats that will no longer be supported for tax periods beginning after 31 December 2024. Companies should check their systems to ensure that the file formats they use are still recognised and adapt them if necessary.

(see KMLZ VAT Newsletter 19/2024: GoBD 2024: What’s new? – Procedural documentation and TCMS rewarding for tax audits)

Summary

The procedural documentation therefore consists of numerous components and is very comprehensive. It cannot be implemented ‘overnight’. Its development is a process in which various players from within the company work together and, in different phases, develop, implement and optimise a concept or develop it further in the long term. For these purposes, it may be advisable to consult an external advisor. We would be happy to advise you!

Contact