Contrary to widespread belief, tax-exempt status under charitable law does not shield organizations from dealing with VAT. The general principles of VAT law also apply to non-profit entities (e.g., associations, foundations). Accordingly, supplies and other services provided by non-profit organizations for consideration, as entrepreneurs within Germany in the course of their business activities are subject to VAT (cf. sec. 1 para. 1 no. 1 sentence 1 of the German VAT Act).

Which activities are considered part of the entrepreneurial sector?

In the case of non-profit organizations, four tax-related spheres are traditionally distinguished: the idealistic sphere, the special-purpose operation, asset management, and the commercial business operation.

This so-called four-sphere model originates from the tax law governing charitable status.When applied to VAT law, it can generally be said that only the revenues from asset management, special-purpose operations, and commercial business operations are considered part of the entrepreneurial sector of non-profit organizations.

In contrast, in the idealistic sphere, the organization typically does not act as an entrepreneur. In such cases, there is often no exchange of services, as genuine membership fees, donations, and genuine grants are not matched by specific services provided by the organization.

Example:

A municipality provides a sports facility to a sports club free of charge for long-term personal use. The club is not required to provide specific operational services to the municipality, such as offering particular sports programs. The club receives a flat-rate reimbursement from the municipality for operating costs. These payments from the municipality constitute a so-called genuine grant. This grant is not subject to VAT.

See VAT Newsletter 12/2022: Contractual grants to sports clubs not necessarily subject to VAT

Example:

A golf club charges its members an annual flat-rate membership fee to serve the overall interests of all members of the club. These are genuine membership fees that are not subject to VAT (cf. sec. 1.4 para. 1 of the German VAT Application Decree – UStAE).

Note:

The administrative view and case law are not entirely aligned. Case law assumes that even flat-rate annual fees can constitute consideration for services provided by the club to its members (ECJ, judgment of 21.03.2002 – C-174/00 – Kennemer Golf). By invoking this case law, substantial input VAT amounts can be claimed for new investments.

Example:

The local car dealership financially supports the local cycling club. The cycling club mentions the dealership’s support on its website, without any special emphasis or linking. This is considered passive sponsorship (cf. sec. 1.1 para. 23 UStAE). There is no exchange of services, so no VAT is incurred.

Which VAT exemptions apply to non-profit organizations?

Taxable transactions are generally subject to VAT unless the law explicitly provides an exemption for a specific transaction. VAT exemption provisions do not depend on the organization’s charitable status under tax law. Nevertheless, transactions by non-profit organizations are often exempt from VAT because these organizations frequently engage in activities that serve the public interest. According to the legislator, such activities should generally not be burdened with VAT.

Whether a specific transaction is exempt from VAT is determined, in particular, by the list of exemptions in sec. 4 of the German VAT Act (German VAT Act). For non-profit organizations, the following VAT exemptions may be especially relevant:

Rental and leasing of real estate (sec. 4 No. 12 German VAT Act)

Medical and hospital treatments (sec. 4 No. 14 German VAT Act)

Care and nursing services (sec. 4 No. 16 German VAT Act)

Services closely related to social welfare and social security (sec. 4 No. 18 German VAT Act)

Services provided by youth hostels (sec. 4 No. 24 German VAT Act) and youth welfare (sec. 4 No. 25 German VAT Act)

Certain cultural institutions (sec. 4 No. 20 letter a German VAT Act)

Certain types of educational services (sec. 4 No. 21, No. 22 letter a, and No. 23 German VAT Act)

Cultural and sports events (sec. 4 No. 22 letter b German VAT Act)

See VAT Newsletter 21/2022: Federal Fiscal Court changes jurisprudence on VAT exemption for sportVoluntary work (sec. 4 No. 26 German VAT Act)

Cost-sharing groups (sec. 4 No. 29 German VAT Act)

Like all entrepreneurs, non-profit organizations may also apply the so-called small business regulation (sec. 19 German VAT Act). The prerequisite for applying this regulation is that the particular organization’s total turnover did not exceed EUR 25,000 in the previous year and is not expected to exceed EUR 100,000 in the current year. If the organization qualifies as a small business, it is not required to submit VAT returns (sec. 19 para. 1 sentence 2 half-sentence 1 German VAT Act).

However, in certain cases, the small business regulation may be economically disadvantageous for an organization (loss of the right to deduct input VAT, sec. 15 para. 2 German VAT Act!). Therefore, it must be assessed on a case-by-case basis whether an organization should waive the application of the small business regulation (sec. 19 para. 3 German VAT Act).

Under what conditions does the reduced VAT rate (7%) apply to non-profit organizations?

If a transaction is taxable and subject to VAT, the standard rate is generally 19% (sec. 12 para. 1 German VAT Act). Only for certain transactions does the law provide for a reduced rate of 7% (cf. sec. 12 para. 2 German VAT Act). For non-profit organizations, sec. 12 para. 2 no. 8 letter a German VAT Act is particularly relevant. According to this provision, the VAT rate for services provided by organizations that exclusively and directly pursue charitable, benevolent, or religious purposes (sec. 51 to 68 AO) is 7% (sec. 12 para. 2 no. 8 letter a sentence 1 German VAT Act).

However, transactions carried out by organizations within the scope of a commercial business operation are subject to the standard VAT rate (sec. 12 para. 2 no. 8 letter a sentence 2 German VAT Act). For special-purpose operations under sec. 66 to 68 AO, the exception in § 12 para. 2 no. 8 letter a sentence 3 German VAT Act must be considered. According to this provision, charitable organizations' transactions in these special-purpose operations are only taxed at 7% if they are not primarily aimed at generating additional income through transactions that directly compete with non-privileged businesses, or if the organization uses these services to directly fulfill its tax-privileged statutory purposes.

For services provided by special-purpose operations under sec. 65 AO, there is no longer a VAT-related examination of competitive relevance.

Do non-profit organizations have a right to input VAT deduction?

A frequent point of contention with the tax authorities is that non-profit organizations seek to benefit from input VAT deduction. In principle, there are no special rules for non-profit organizations regarding input VAT deduction. The requirements are governed by sec. 15 of the German VAT Act. According to this provision, an entrepreneur may deduct the legally owed VAT as input tax if it results from supplies and services received for their business (sec. 15 para. 1 no. 1 sentence 1 German VAT Act). To exercise the right to deduct input VAT, the organization must be in possession of a proper invoice (sec. 14, 14a German VAT Act) (cf. sec. 15 para. 1 no. 1 sentence 2 German VAT Act).

If the non-profit organization uses the input service for VAT-exempt transactions, it may not claim input VAT deduction (cf. sec. 15 para. 2 no. 1 German VAT Act). The decisive factor is how the organization intends to use the input service.

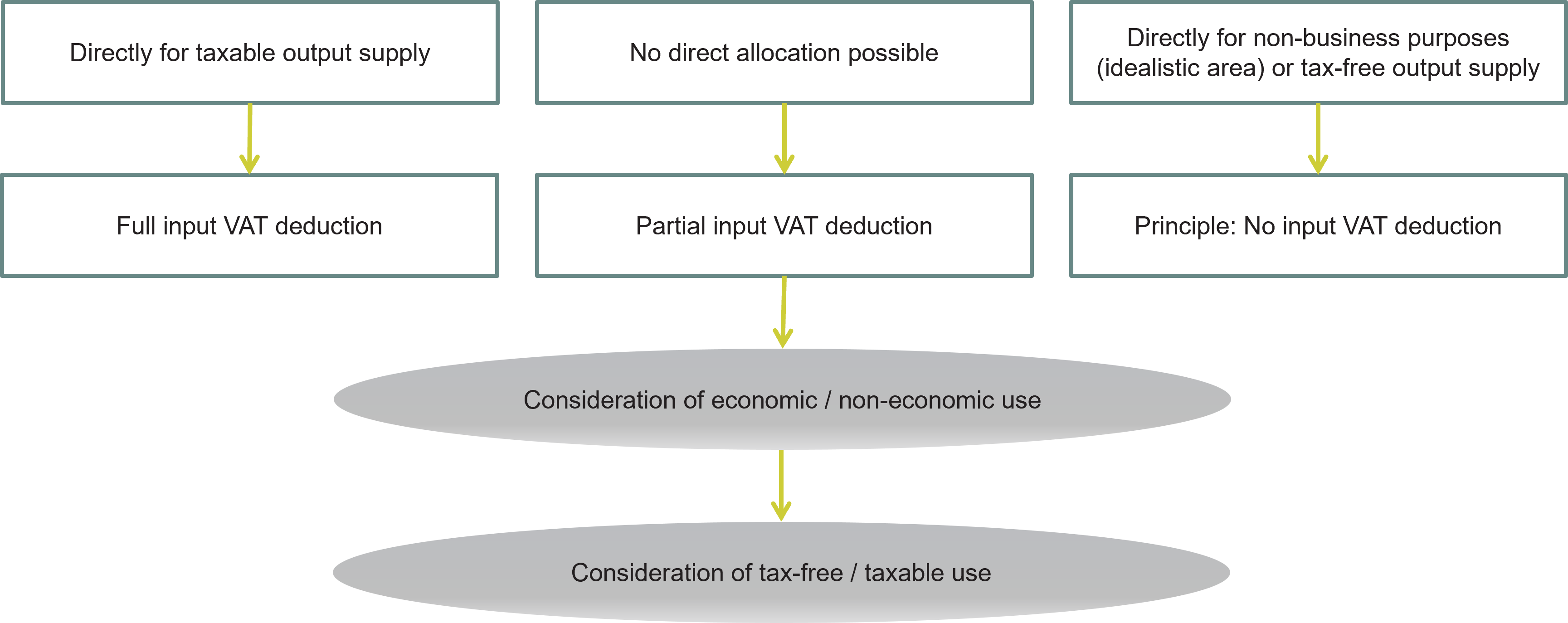

Direct allocation of input services

As a first step, the organization must directly allocate the specific input service to an output transaction. It must examine whether and to what extent input services are used exclusively for non-business purposes. If input services are used exclusively for non-business purposes, input VAT deduction is excluded. If input services are used exclusively for business purposes, input VAT deduction is generally permitted.

For this group of input services, the organization must then determine whether the input service is used to perform an output transaction that allows input VAT deduction (in which case full deduction is possible) or one that does not (in which case no deduction is allowed).

Mixed use of input services

If direct allocation is not possible, the organization must apportion the input VAT from services used both for business and non-business purposes (analogous to sec. 15 para. 4 German VAT Act). Only the portion used for business purposes may be deducted. If such non-directly allocable input services are used for business purposes, they are considered general business expenses (so-called overhead costs). Input VAT deduction for these services is possible on a proportional basis, provided they relate to output transactions that do not exclude deduction. The organization must determine an input VAT ratio by means of a reasonable estimate (sec. 15 para. 4 German VAT Act).

Example 1:

A choir club purchases songbooks online (plus 7% VAT). The songbooks are used for rehearsals and free performances. The choir cannot deduct the VAT paid on the songbooks as input tax. The input services (songbooks) are directly attributable to the idealistic (non-business) sphere of the choir.

Example 2:

A handball club organizes a summer festival where it plans to sell food and drinks to visitors. The club purchases the food and drinks from a wholesaler. The wholesaler invoices the club including 19% VAT. The handball club can generally deduct the VAT shown on the invoice as input tax. The input services (food and drinks) are directly attributable to the (entrepreneurial) commercial business operation of the club (organizing the summer festival).

Smaller non-profit organizations also have the option of applying the so-called flat-rate input VAT deduction (sec. 23a German VAT Act).

Contact