Automated Validation of E-Invoices according to EN 16931

The introduction of mandatory e-invoicing is not just a step toward digitalization but a complex regulatory challenge. Since 1 January 2025, only invoices that comply with the CEN standard EN 16931 are recognized as e-invoices. This standard defines a structured, machine-readable data model and requires adherence to both technical syntax (e.g., UBL or CII) and semantics. This ensures that invoices are not only formally correct but also logically consistent and can be fully processed automatically.

The German Federal Ministry of Finance places even greater emphasis on the technical validation of e-invoices in its circular of 15 October 2025. In addition to the traditional check of mandatory information (sec. 14 and 14a of the German VAT Act), the Ministry explicitly requires verification of semantics and syntax. Companies must ensure that their invoices are not only formally correct but also comply with business rules and logical dependencies.

The circular distinguishes three types of errors:

- Format errors: Occur when an e-invoice does not comply with the permitted syntaxes or technical specifications.

- Business rule errors: Technical requirements or rules regarding logical dependencies of information (= semantic requirements) are not met.

- Content errors: “Classic” errors such as incorrect or missing mandatory invoice details.

Our experience shows: Many companies currently use solutions that only cover partial aspects of validation or interpret the EN 16931 requirements inconsistently. This leads to risks for input VAT deduction.

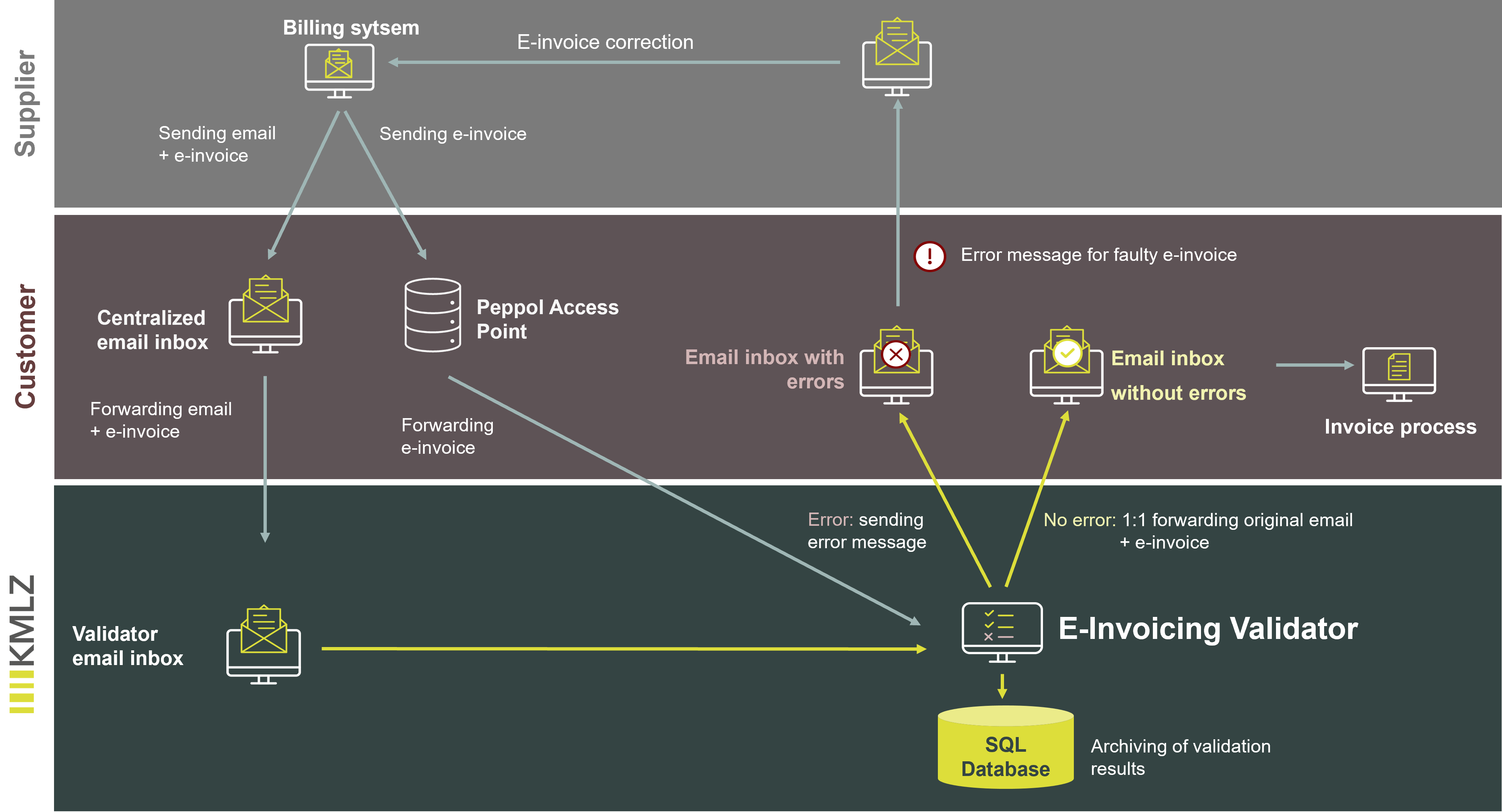

With the KMLZ E-Invoicing Validator, we provide a solution to the new legal requirements and the practical challenges companies face. Our tool is specifically designed to validate e-invoices automatically and reliably — without extensive implementation effort.

Easy Integration: The E-Invoicing Validator integrates seamlessly into the existing incoming invoice process and operates in the background, so major process changes are not required.

Transparent Error Analysis: For faulty files, you receive a precise, clearly structured overview of all issues, enabling your suppliers to correct the right points in the e-invoice creation process.

Audit-Proof Results: All analyses and validation results are documented in an audit-proof manner and can be presented at any time. This is a key component for compliance, internal controls, and demonstrating the “due diligence of a prudent merchant”.

Data Protection: The e-invoice files analyzed by the E-Invoicing Validator are used exclusively for automated validation and are automatically deleted afterward.

Legal Certainty & Compliance: Validation for format errors, business rule errors, and content errors – fully compliant with EN 16931 and the requirements of the Federal Ministry’s circular of 15 October 2025

Seamless Integration: Easily integrated into existing processes without major adjustments

Clear Error Overview: Understandable summary and detailed validation report

Audit-Proof Documentation: Archiving of all validation results with full traceability at any time