Process documentation – structured, comprehensible, and audit-proof

With the transition to digital invoicing, businesses are becoming more efficient – however, this also increases the requirements for traceability and documentation of processes. The Principles for the Proper Management and Storage of Books, Records and Documents in Electronic Form as well as for Data Access require comprehensive process documentation that describes the entire digital invoice workflow: from invoice receipt through verification and approval to invoicing and archiving. Both technical systems and organizational processes, including control mechanisms, must be documented in a transparent and comprehensible manner.

With the transition to digital invoicing, businesses are becoming more efficient – however, this also increases the requirements for traceability and documentation of processes.

Legal requirements demand comprehensive process documentation that describes the entire digital invoice workflow: from invoice receipt through verification and approval to invoicing and archiving.

Both technical systems and organizational processes, including control mechanisms, must be documented in a transparent and comprehensible manner.

In practice, however, there is often a lack of transparency about what needs to be documented, how detailed the description should be and who is responsible for it.

The challenge lies in documenting both the technical and tax-related requirements in a complete, comprehensible and up-to-date manner.

In addition to complying with the legal requirements, businesses must also ensure that their processes meet the requirements of the German Value Added Tax Act. One particularly critical aspect is the input VAT deduction: if evidence of the authenticity, integrity and legibility of digital invoices or internal control procedures are insufficiently documented, the right to deduct input VAT may be denied.

With our Documentation Check, we support businesses in creating procedural documentation that complies with both legal and VAT regulations.

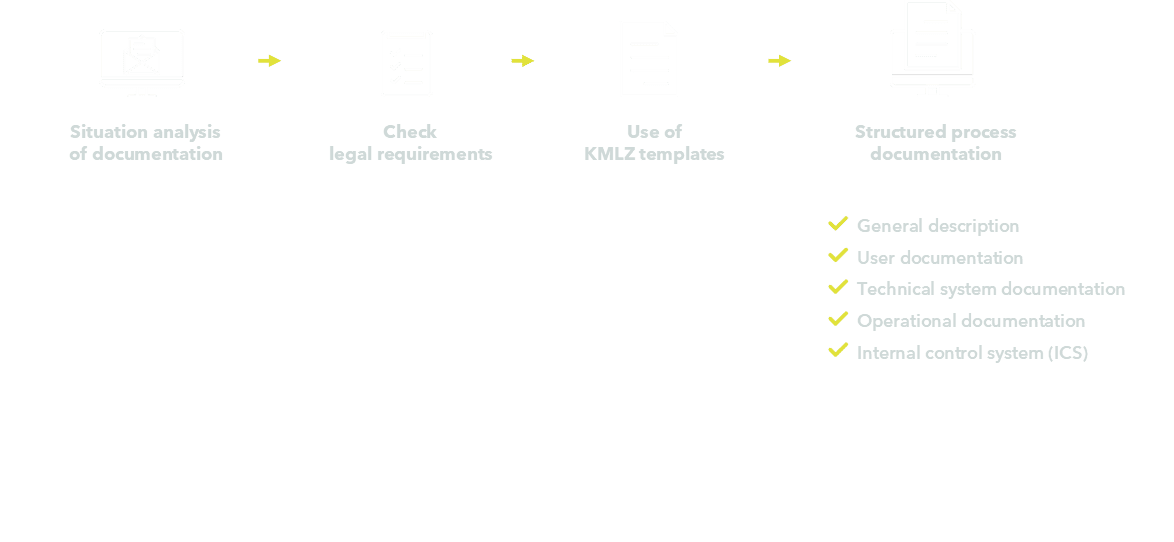

As part of a structured situation analysis, we examine how digital invoicing processes are organized within the company: Which systems are in use? Who is responsible for what? What internal control mechanisms are implemented?

Subsequently, we review the documentation already available for completeness and compliance with legal requirements. Using our proven KMLZ templates for complete processdocumentation, we assess whether existing documents are complete and provide targeted support in the creation of missing content.

As a result of the joint consulting project, a structured process documentation for the invoicing process is created.

Transparency regarding processes and responsibilities

Efficient creation of procedural documentation thanks to targeted consulting and the use of proven KMLZ templates

Existing documents are reviewed concerning legal compliance and supplemented as needed

Structured and complete documentation

Individual consulting instead of standard solutions

Legal certainty during tax field audits