Chain transactions are a special feature in VAT law. Specific rules apply for determining the place of supply and for assessing whether (and which) supply is VAT-exempt. When dealing with a potential chain transaction, the following review scheme should be applied:

Is it a chain transaction?

Which supply is associated with the transport of the goods?

Where is the place of supply?

- for the supply with transport

- for the supplies without transportIs the supply with transport VAT-exempt?

VAT Newsletter 29/2022: Safety-net acquisition tax applies for using VAT-ID from country of departure - but not in case of double taxation

VAT Newsletter 05/2019: Quick Fix re chain transactions within the EU – Implementation of a definition and regulations concerning the allocation of the transport

What is a chain transaction?

A chain transaction is a specific form of goods trading involving three or more parties, where the goods are resold consecutively but are physically shipped directly from the first supplier to the final customer. The definition of a chain transaction is set out in sec. 3 para. 6a sentence 1 of the German VAT Act (UStG). For intra-EU transactions, the definition is found in Art. 36a (1) of the EU VAT Directive (MwStSystRL).

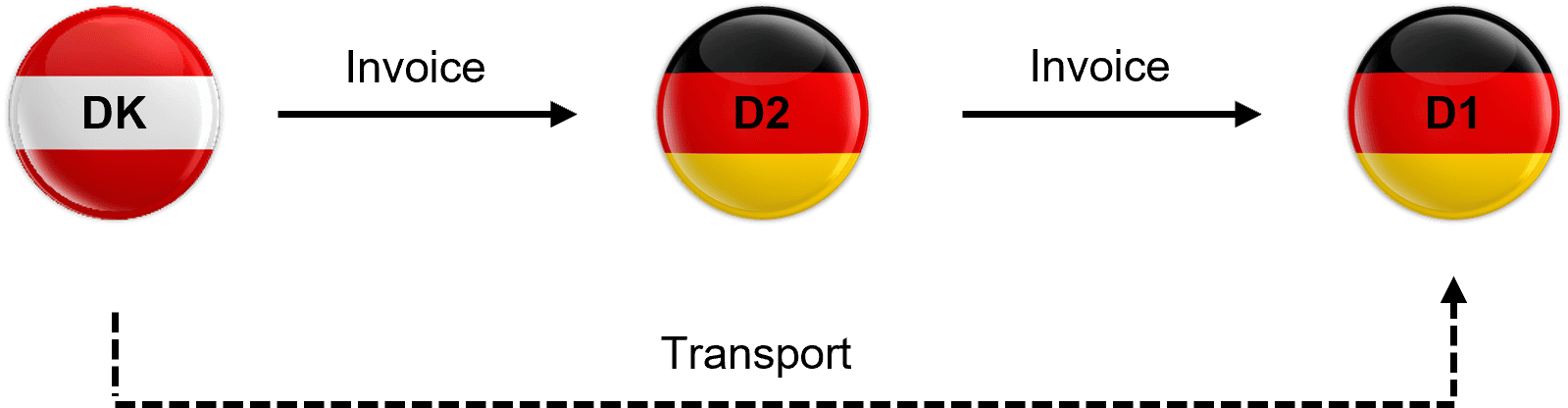

Example:

Business D1 in Munich orders out-of-stock electronic devices from wholesaler D2 in Düsseldorf. D2 places the order with manufacturer AT in Austria. AT ships the devices directly to Munich, where D1 receives them.

From a VAT perspective, multiple supplies occur in a chain transaction. Each must be considered separately with respect to place and time of supply, even if there is only one movement of goods.

If the goods do not go directly from the first supplier to the final customer — for example, due to a "broken transport" — this is not a chain transaction. A broken transport exists if individual legs of the transport are commissioned or carried out by several of the taxable persons involved in the chain transaction.

However, even short interim storage does not automatically preclude classification as a chain transaction if the final recipient receives the goods directly.

VAT Newsletter 48/2020: Tax Court Affirms Chain Transaction in the Case of Partial Transport Orders

Why and how is the transport of goods allocated?

Only one of the supplies is connected with the transport of goods. It is crucial to identify this one, because only the supply with transport can benefit from VAT exemptions for exports (sec. 6 of the German VAT Act) or intra-Community supplies (sec. 6a of the German VAT Act).

All other supplies without transport take place either before or after the cross-border transport.

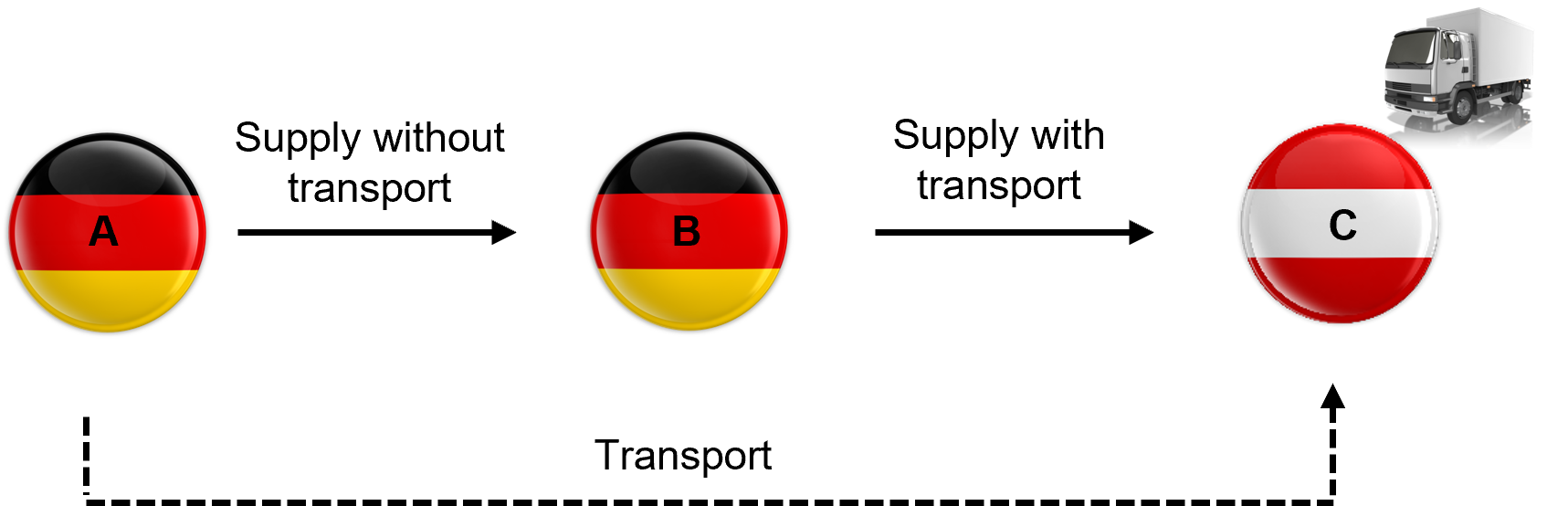

1. Transport by the first supplier

If the first taxable person in the chain carries out the transport or orders the transport, it is attributed to his supply (sec. 3 para. 6a sentence 2 of the German VAT Act).

2 Transport by the final customer

If the final customer carries out the transport or orders the transport, it is attributed to the supply to him (sec. 3 para. 6a sentence 3 of the German VAT Act).

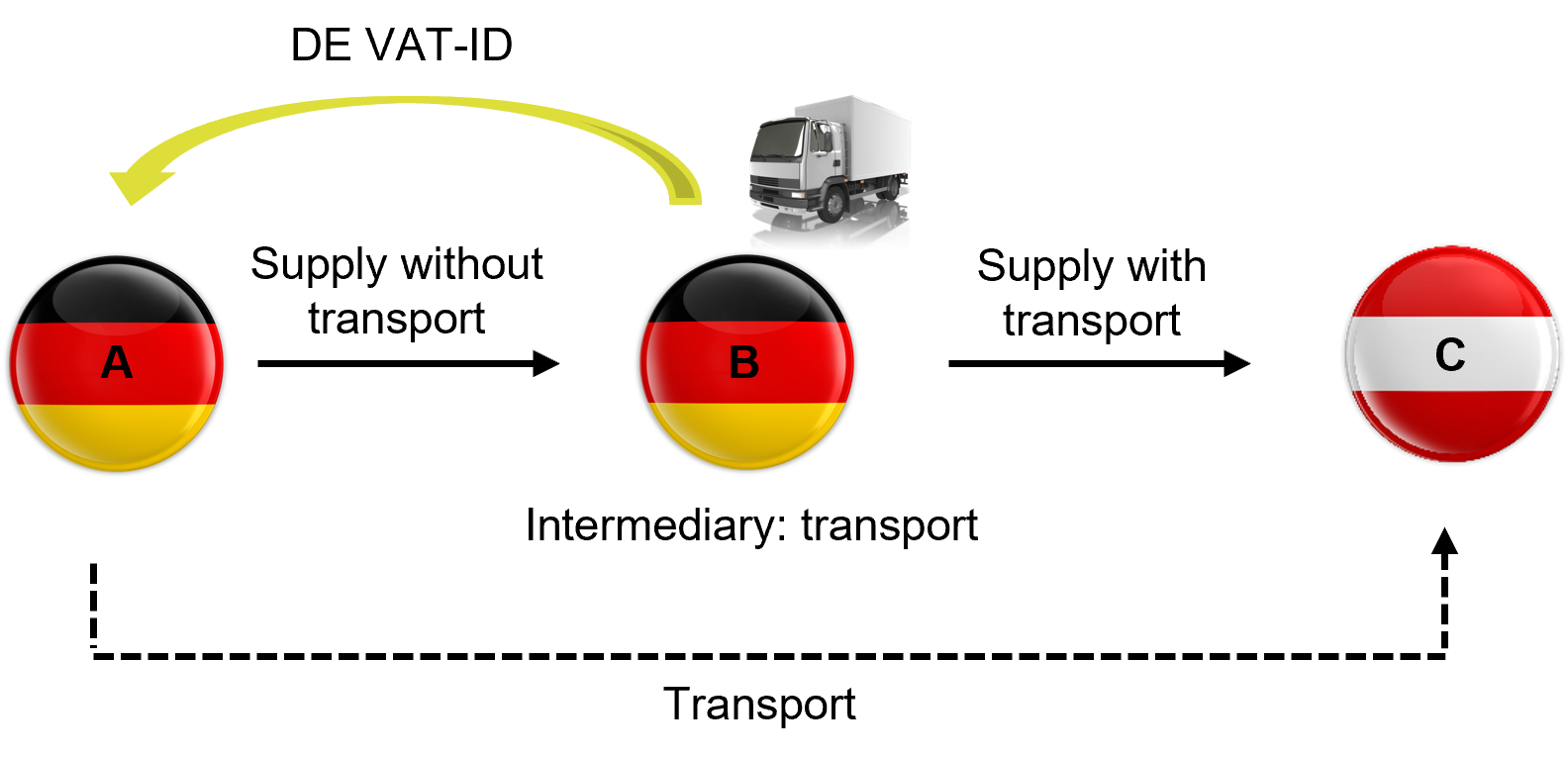

3. Transport by intermediary

If an intermediary — who is both customer and supplier — carries out the transport or orders the transport, it is generally assigned to his supply (sec. 3 para. 6a sentence 4 of the German VAT Act).

However, the intermediary can shift the allocation by proving he acted as supplier when transporting the goods.

a) Transport within the EU

If the goods are transported from one EU Member State to another and the intermediary uses a VAT-ID from the departure country vis-à-vis the preceding supplier prior to the moment the transport commences, the transport is assigned to the intermediary’s supply (sec. 3 para. 6a sentence 5 of the German VAT Act).

b) Export from Germany to non-EU country

If the goods are transported from Germany to a non-EU country and the intermediary uses a VAT-ID or tax number from the departure country vis-à-vis the preceding supplier prior to the moment the transport commences, the transport is assigned to the intermediary's supply (sec. 3 para. 6a sentence 6 of the German VAT Act).

c) Transport from non-EU country to EU

If the goods are transported from a non-EU country into Germany, the transport is assigned to the intermediary’s supply if the goods are customs-cleared in his name or in his indirect representative’s name (sec. 3 para. 6a sentence 7 of the German VAT Act).

VAT Newsletter 22/2023: Ministry of Finance letter on chain transactions - particularly on assignment of the transport and communication of the VAT-ID

VAT Newsletter 29/2020: ECJ: Transportation arrangement is not only based on contractual agreements

VAT Newsletter 03/2020: Quick Fixes 2020 – Update

VAT Newsletter 40/2019: Implementation of the Quick Fixes 2020 on the home straight – part 2

VAT Newsletter 08/2018: ECJ: Subjective knowledge and protection of legitimate expectations in chain transactions

How is the place of supply determined?

Once the transport of goods is allocated, the place of supply can be determined:

• Supply with transport: place of dispatch (sec. 3 para. 6 sentence 1 of the German VAT Act)

• Supply prior to transport: place of dispatch (sec. 3 para. 7 sentence 2 no. 1 of the German VAT Act)

• Supply after the transport: place of arrival (sec. 3 para. 7 sentence 2 no. 2 of the German VAT Act)

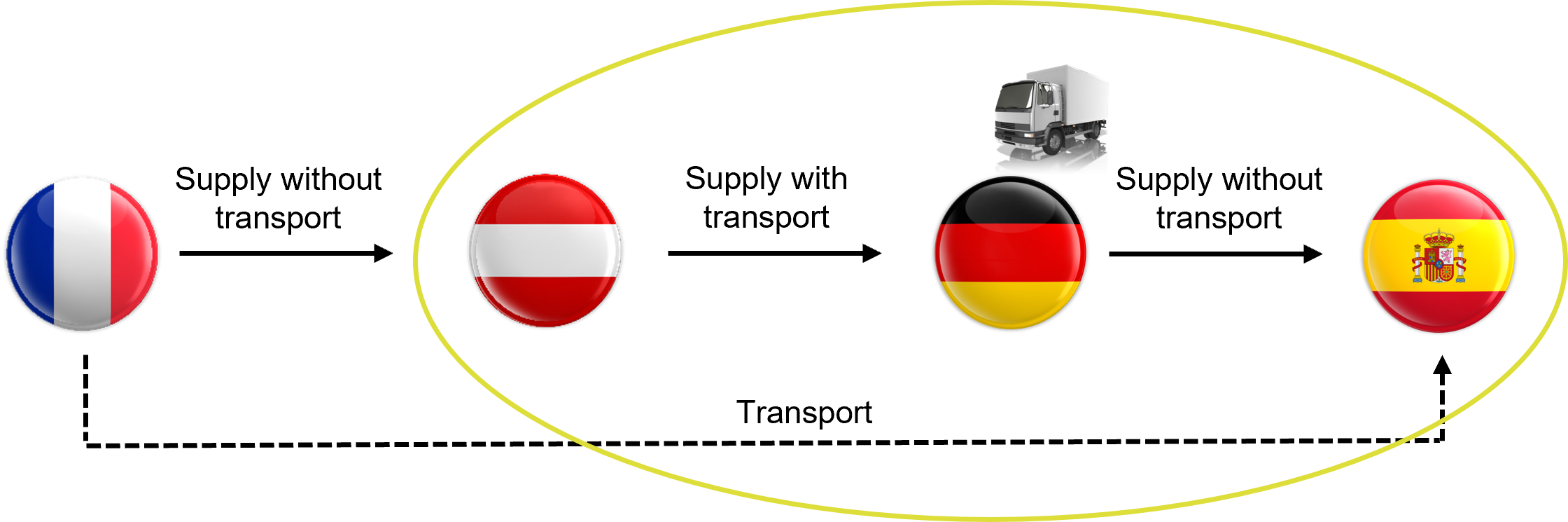

Beispiel:

French company F1 orders a machine from French wholesaler F2. F2 orders from German company D1, which in turn orders from D2 in Dresden. D2 ships the machine directly to F1 in France.

Here, three supplies occur (D2 → D1, D1 → F2, F2 → F1). The first is the supply with transport (D2 → D1), place of supply = Dresden (Germany) where the transport commences according to sec. 3 para. 6a sentence 2 in conjunction with sec. 3 para. 6 sentence 1 of the German VAT Act. The other two are supplies without transport, and their place of supply is France where the goods are transported to since these supplies follow the supply with transport (sec. 3 para. 7 sentence 2 no. 2 of the German VAT Act).

Note: The rules for allocating the transport are harmonized within the EU to a large extent by Art. 36a EU VAT Directive and the relevant ECJ jurisprudence (particularly with the decision of 06.04.2006 in the case EMAG Handel Eder, C-245/04). Hence, the principles mentioned above are applicable for all chain transactions between EU Member States. However, transactions involving non-EU countries are not harmonized, which means that other EU Member States may apply different rules. Furthermore, the non-EU countries involved may have specific rules which may result in double taxation / non-taxation risks — e.g., Switzerland considers all supplies to take place at the start of transport.

VAT Exemption

In a cross-border chain transaction, only the supply with transport can qualify as a VAT-exempt export (sec. 6 of the German VAT Act) or intra-Community supply (sec. 6a of the German VAT Act). All other supplies in the chain are without transport and therefore cannot benefit from those exemptions. Supplies preceding the transport are generally taxable in the dispatch country; supplies after the transport are generally taxable in the destination country.

Third-party Orders

Chain transactions are often colloquially called third-party orders. However, “Third-party Orders” is technically an SAP term for a process in which a company accepts customer orders and forwards them directly to a supplier, who ships products straight to the customer without the goods passing through the company’s warehouse (transaction TAS). It is a form of direct shipping or drop-shipping.

Typical SAP TAS process steps:

1. Customer places order with company.

2. Company records order in SAP and creates a sales order.

3. Sales order is forwarded to the supplier (third party).

4. Supplier ships products directly to customer.

5. Company informs customer of shipment and supply.

What is a triangular transaction and how does it differ from a chain transaction?

A triangular transaction is a special case of an intra-EU chain transaction under sec. 25b para. 1 of the German VAT Act, with these requirements:

1. Three different taxable persons in three different EU Member States are involved

(sec. 25b para. 1 sentence 1 no. 1 of the German VAT Act).

According to German law, an intra-Community triangular transaction may also exist between three taxable persons within chain transactions involving more than three parties, provided that these three taxable persons are at the end of the supply chain.

However, the General Court decided that a triangular transaction may also exist between the three first taxable persons within a chain transaction involving more than three parties.

VAT Newsletter 48/2025: Triangular Transactions in Focus: General Court Rejects German Tax Authority’s View

2. The three taxable persons are each identified for VAT purposes in different EU Member States

(sec. 25b para. 1 sentence 1 no. 2 of the German VAT Act).

Establishment in one of these EU Member States is not required; what matters is that the taxable person acts under the VAT-ID issued to him by one of these EU Member States. If several of the taxable persons involved in the triangular transaction act under VAT-IDs issued by the same EU Member State, it does not constitute an intra-Community triangular transaction.

3. Goods move from one EU Member State to another

(sec. 25b para. 1 sentence 1 no. 3 of the German VAT Act).

4. The goods are transported by the first supplier or by the first acquirer / intermediary

(sec. 25b para. 1 sentence 1 no. 4 of the German VAT Act).

However, this applies to the intermediary only if he transport is attributed to the supply to him (the first supply in the triangular transaction). If, on the other hand, the transport is attributed to the second supply in the triangular transaction because the intermediary acts in his capacity as supplier, then there is no intra-Community triangular transaction. Likewise, if the transport is carried out or ordered by the final customer, there is also no intra-Community triangular transaction.

5. Under sec. 25b para. 2 of the German VAT Act, the first acquirer must issue an invoice to the his customer in accordance with sec. 14 para. 7 of the German VAT Act without VAT that includes:

a reference to the triangular transaction, e.g. “Intra-Community triangular transaction under sec. 25b UStG” or “Simplification according to Art. 141 EU VAT Directive”.

a reference to the VAT liability of the last acquirer (reverse charge)

the VAT-ID of the intermediary of the triangulation

the VAT-ID of the last acquirer of the triangulation.

Sec. 25b of the German VAT Act contains a simplification rule to avoid VAT registration of the intermediary in the destination Member State. In the case of an intra-Community triangular transaction, the following transactions are generally carried out, taking into account the general rules for chain transactions:

an intra-Community supply by the first supplier involved in the triangular transaction in the EU Member State where the transport begins,

an intra-Community acquisition by the intermediary involved in the triangular transaction in the EU Member State where the transport ends,

an intra-Community acquisition by the intermediary in the EU Member State that issued the VAT-ID used by the intermediary, and

a (domestic) supply by the intermediary in the EU Member State where the transport ends.

If an intra-Community triangular transaction exists, the VAT liability for the (domestic) supply is transferred from the intermediary to the last acquirer involved in the triangular transaction under the conditions of sec. 25b para. 2 of the German VAT Act. In the case of this transfer of VAT liability, the intra-Community acquisition by the intermediary is also deemed to be taxed in accordance with sec. 25b para. 3 of the German VAT Act. As a result, the intermediary is spared from VAT registration in the destination Member State.

VAT Newsletter 56/2022: ECJ on invoice correction in case of “unsuccessful” triangulations

VAT Newsletter 28/2019: Quick Fixes: EU VAT Committee comments on questions in doubt

VAT Newsletter 18/2018: Triangulation supplies: ECJ eases restrictions and reduces risks

Contact